Do you feel like you trade with the “buy; then hope, wish and pray for a profit” system?

All successful traders have a plan when they trade. They have specific technical setups and they have previously determined and staunchly followed exits, which get them out quickly if they’re wrong, or which lets their profits ride.

No one knows for sure if the equity will trade up or down in the next minute, the next 15 minutes, the next hour or the next year. And great traders don’t worry about that. All they care about is having a system that they follow assiduously day in and day out for profits.

A system for entry points and exits gives a trader and expectation for directional movement and magnitude of that movement. This expectation helps them implement their trading plan. Implementing their trading plan gets them into the market. Getting into the market is key because without being in the market, they can’t profit!

Need to start building your trading plan? Get started with the Forex cornerstones e-book.

Once in the market (because of an expectation), the successful trader follows their plan and takes action based on the reality of what actually happens in the market. They don’t second-guess themselves based on what they hope will happen. They don’t dither while they wish and pray for a profit. They simply take action according to their system based on the reality of what the market gives them.

Let’s say your system has just 4 components:

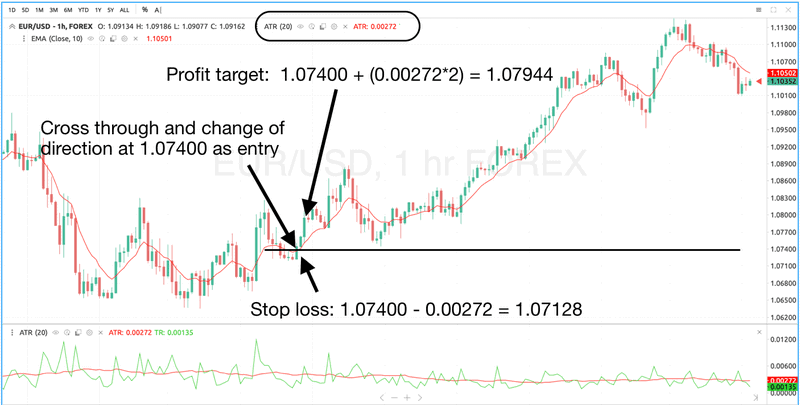

- Trade on a 1-hour EUR/USD chart

- Use a cross through (and change of direction) or bounce off the 10-period exponential moving average as the entry

- Risk 1 average trading range (ATR) to make 2 ATR for a profitable exit

- If the trade moves against you, get out at your stop loss

Here is a EUR/USD chart with a trade mapped out according to this system:

Each of the candles on this chart represents 1 hour of time. The trade shown happens over the course of 3 hours. There are multiple possible entry points trading both bullish and bearish over the timeframe shown on this chart. Take some time to identify the entries and set the stops and profit targets according to the rules of this system (risk 1 ATR to make 2 ATR).

Over the course of your trading life, you will be tempted to change your rules, sometimes even on the fly in the middle of the trade. Don’t. A rules-based system gives you an expectation for the trade and lets you adjust your expectation to the reality that happens in the markets….over and over again in a repeatable way.

Trading with a rules-based approach is the only way to have enduring success as a trader.