Trading Along a Bearish Trendline

The Forex market is open 24 hours a day, which can be daunting to new market participants. More experienced traders might have a problem shutting down for the day, which might cause them to overtrade their accounts. Either way, the important thing to remember is that there is a rhythm to Forex trading where it moves faster and farther at certain times of the day than others. Whatever pair or pairs you choose to trade, be aware of this fact and be cautious until you have a good sense of that pair’s trading rhythm.

Successful traders tend to practice good money management and trade discipline by limiting their risk to a small percentage of their overall account on any one trade. They also typically avoid adding too much risk or leverage on their positions. It is very tempting to use max leverage on each trade for higher gains…but don’t. Be cautious, protect your gains, avoid big losses and work to maximize each win.

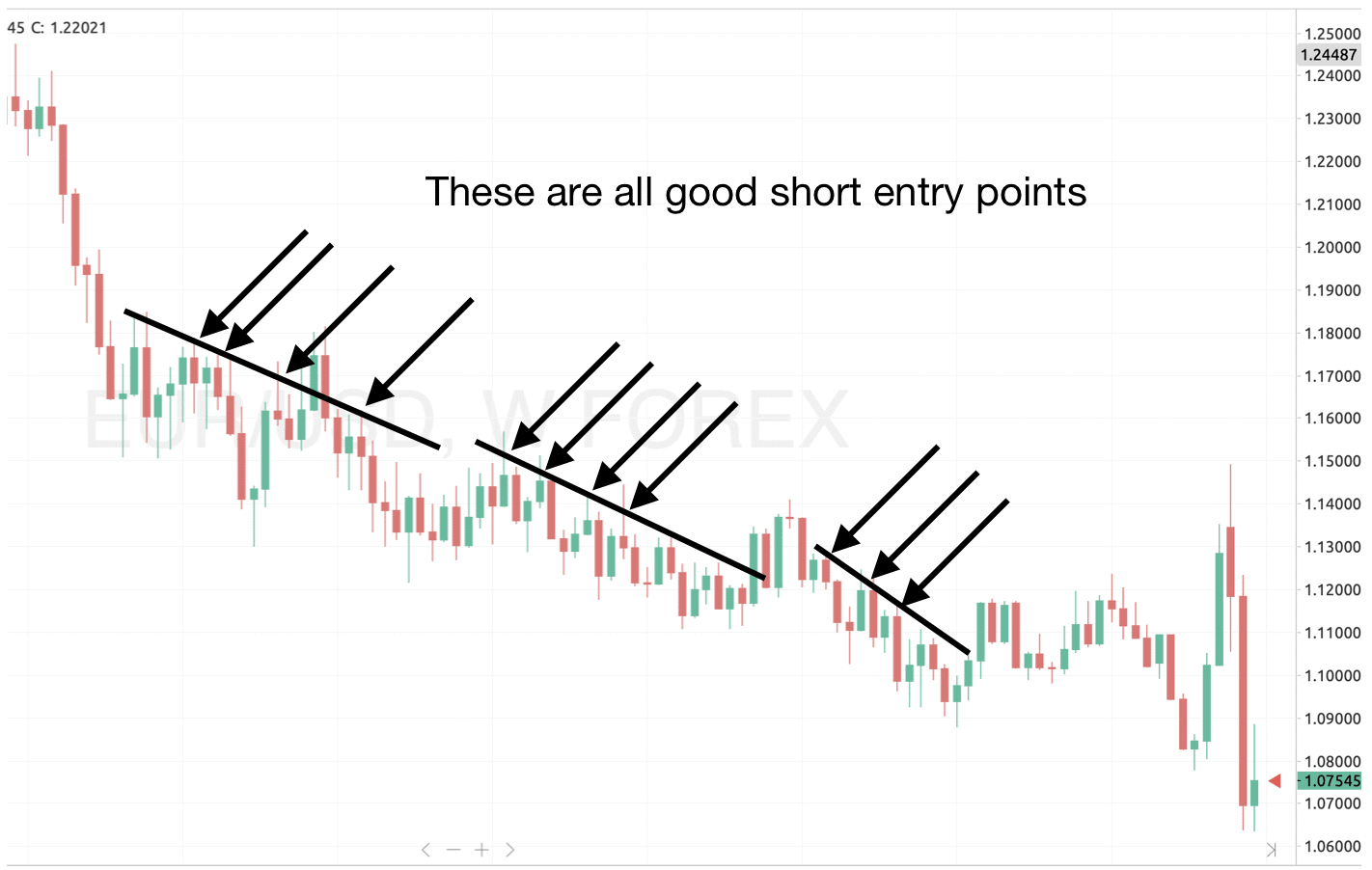

One way to maximize your wins is to find longer-term trends using a daily or weekly chart (see below for a weekly chart example on the EUR/USD) using support or resistance lines to trade the overall direction. Using even a simple indicator like a trend line is known as trading with an edge. More experienced traders may use a few indicators over a few timelines to help them identify a trend early and stick with it longer. But even new traders can be successful with a simple indicator shown below. Some people may want to trade both sides, but in many cases, the safer approach is to trade only in the direction of the trend.

The strategy (and trading edge) in this bearish example is to only enter a short trade and to only enter it every time the chart hits and bounces down off the resistance lines shown.

This weekly chart shows about 6 months of downtrend during which 11 longer-term trades could have been placed. There were only a couple of times during this run when the chart closed above the trend line.

In both cases, following the system (a bounce down off the trend line) would have avoided entering a bearish trade until the trend was confirmed as shown in the chart.

Increasing your skills for identifying and then following a trading strategy like a trend line may help you become a more profitable Forex trader.